Know your customer capabilities to support anti-money laundering compliance

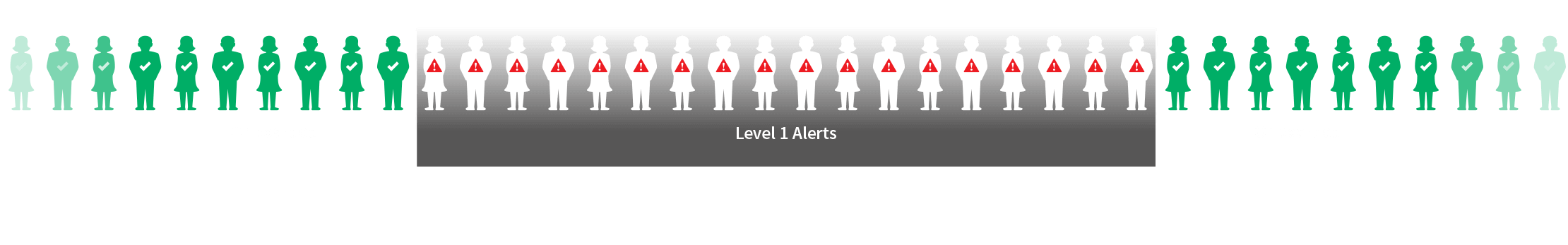

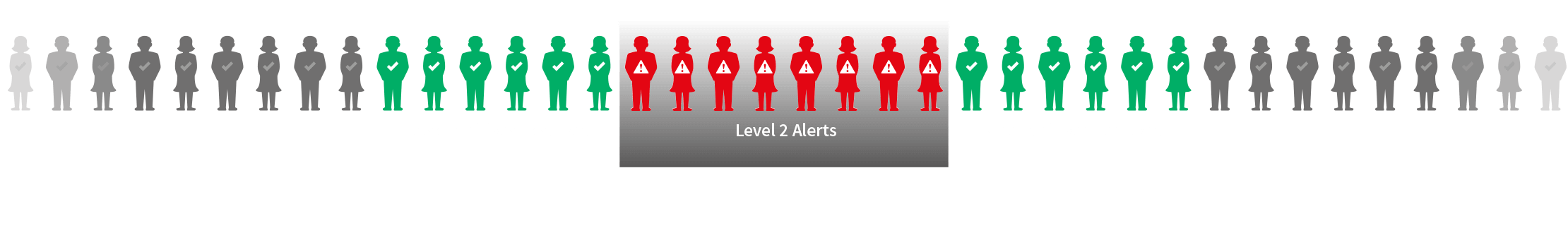

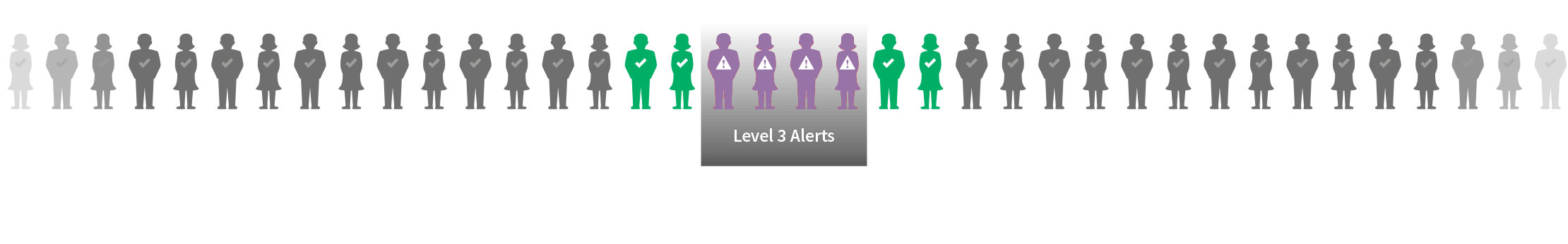

LexisNexis® Risk Solutions helps you instantly verify identities of new and returning customers and screen for sanctions, politically exposed persons (PEPs) and adverse media. Our market-leading solutions support you with effective customer due diligence; enabling the ongoing monitoring of your customer accounts, alerting you to risks as and when they arise, and supporting remediation through enhanced due diligence (EDD) capabilities. Through a single trusted relationship, you can tackle the threat of money laundering head on.